Lignite will be phased out by 2028 in Greece based on the ongoing energy policy planning. This entails a significant structural change for the Greek power sector, as lignite comprises the only domestically extracted fossil fuel for power generation.

The intentions to phase out lignite plants and incrementally increase the installed Renewable Energy Sources (RES) capacity positions imported natural gas as the intermediate fuel for base power generation in Greece. However, the recent Russian war against Ukraine has brought up the urge for Europe to rapidly reduce its gas dependence. At the same time, the consequent energy crisis has affected the uncertainty of commodity availability and has led to the skyrocketing of natural gas prices. Ultimately, the rising EU ETS carbon and natural gas prices have direct impacts on the wholesale electricity price. Furthermore, given the likelihood of limited gas supply, increased lignite use in power generation has been recently considered as a key mitigation measure.

Considering the above, we posed the following research questions:

- What would be the expected contribution of fossil-fuel and RES generating units in the electricity mix in 2030? What level of power independency could be achieved?

- How would the wholesale electricity price be affected?

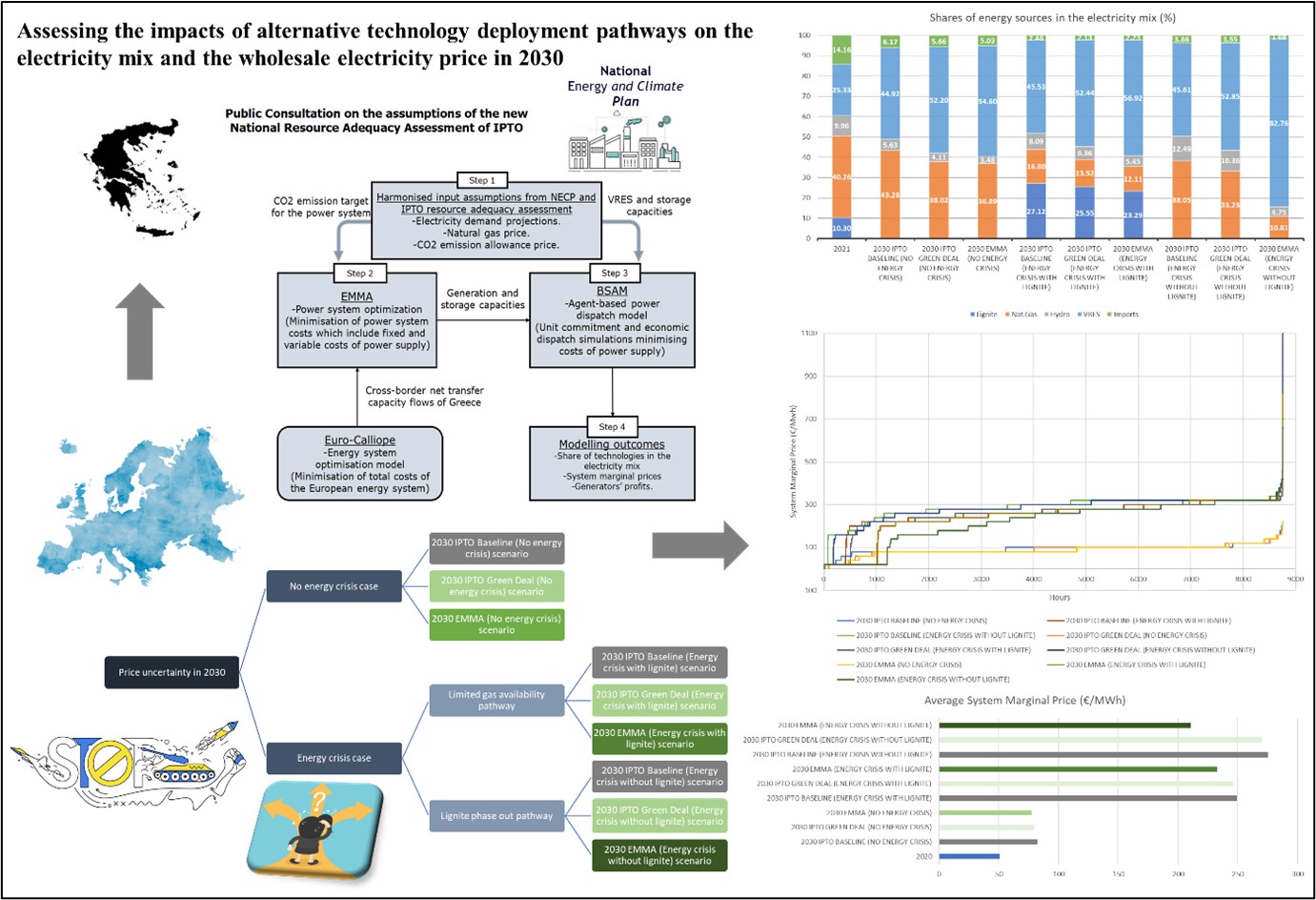

Using an integrated modelling framework consisting of the EMMA and BSAM models, and the input from Euro-Calliope, we explored different technology deployment scenarios regarding the Greek power sector, towards the emission targets of the National Energy and Climate Plan and supply assumptions from the National Resource Adequacy Assessment (NRAA) published by the Greek Independent Power Transmission Operator in summer 2021.

We simulated scenarios under two different cases of gas price uncertainty:

- No energy crisis case: The energy system evolves given the conditions before the energy crisis. Projections for the natural gas and carbon prices were made using a trendline, fit to the price developments by the end of 2021 and projections mentioned in the NRAA report.

- Energy crisis case: The energy system evolves based on the current status quo. Projections were made similarly based on the price developments by June 2022.

The Energy crisis case was modelled under two different technology deployment pathways considering gas availability:

- Limited gas availability: Prolongation of lignite use (extreme scenario considering that natural gas availability in 2030 will be limited).

- Lignite phase-out pathway: Sticking to the lignite phase-out plan of the government, with potential large uptake of RES.

Modelling results showed that if significant efforts for increase in VRES capacity do not materialise, a negligible reduction of electricity dependence can be achieved given the projections for increased electricity demand, making Greece being much dependent on natural gas and electricity imports from other countries by the end of the decade. This highlights the need for more disruptive VRES capacity targets towards higher self-sufficiency levels for electricity supply in Greece. More interventions to avoid potential lock-in to natural gas, e.g., further increase in VRES and storage capacities, appear necessary to (i) achieve the national emission targets, and (ii) reduce Greece’s dependence from fuel imports. Considering the increasing trend of natural gas price as well as the probability of limited natural gas availability and slow VRES capacity growth, the lignite phase-out decision might need to be extended until 2030, since lignite could serve as an alternative baseload source of electricity generation.

Moreover, the profit-maximising behaviour of generators, who tend to pass the projected increases in carbon and natural gas prices to the electricity wholesale market, may lead to unbearable electricity prices. With increased VRES capacity and lower residual demand, the competition among generators becomes stronger, thus keeping their profit margins narrower. If the share of VRES sharply increases, it could in fact be a driver for a reduction in the increasing slope of electricity prices. However, an ambitious VRES capacity expansion is not an adequate strategy by itself to balance the disruptions caused in the electricity price. In the case that the VRES capacity growth is moderate, extending the lignite use would also not be enough on its own to mitigate the rise in the electricity price. Other suitable policies should also be considered to shield final consumers, e.g., decoupling of last (and most expensive) bidder from electricity price setting.

Paper: Preliminary modelling results from this analysis are included in Michas et.al, 2022.

Models used

BSAM

Agent-based simulation model

DetailsEMMA

Electricity system optimization model

DetailsEuro-Calliope

SENTINEL case study

Case study: National – Greece

Country-specific case with focus on coal phase-out together with a large domestic renewable potential.

Details